nebraska inheritance tax worksheet 2021

Nebraska State Bar Association 635 S. Patricias son inherits 50000.

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Her estate is worth 250000.

. If the same rate is in effect for more than one month the link provided. Life EstateRemainder Interest Tables REG-17-001 Scope Application and Valuations 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other. Tax Prep Worksheet 2018 Universal Network.

By JD Aiken 1996 The Nebraska inheritance tax is imposed on all property inherited. Nebraska Tobacco Products Tax Return for Products Other than Cigarettes 122019 56. Oct 16 2019 Introduction.

Nebraska Inheritance Tax Worksheet 2021. Patricias husband inherits 125000. Nebraska Inheritance Tax Worksheet Resume.

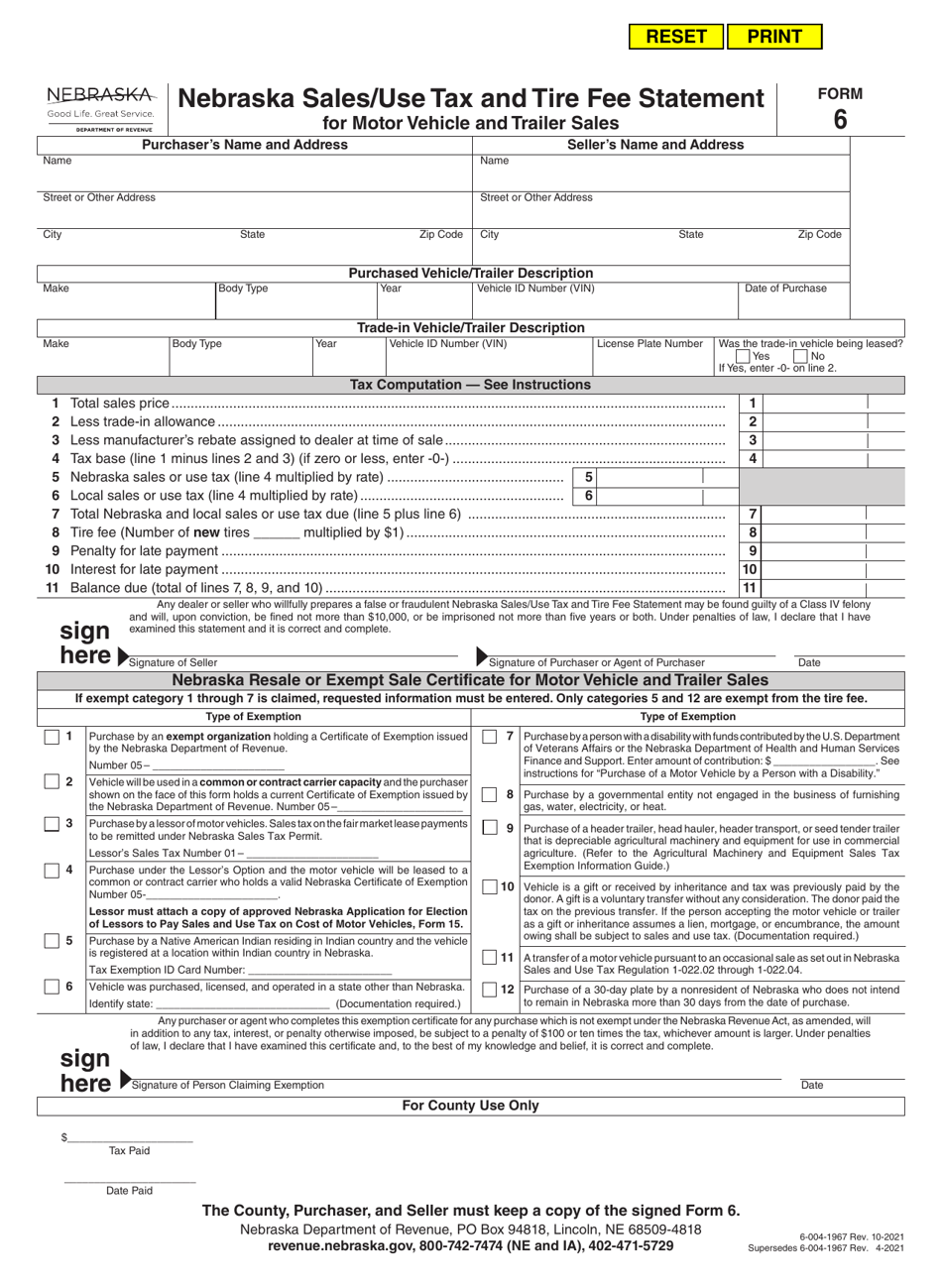

Nameplate Capacity Tax - Repealed 07052020 Title. Sales and Use Tax 06242017 Title 316 Chapter 9. Practice your Addition Subtraction Mutliplication and Division - self-marking Online exercises.

On a statewide basis inheritance tax collections in Nebraska have ranged from a 189 to 733 million since 1993 337 to 745 million if adjusted for inflation into 2020 dollars. Form 6 Ordering Other Years Income Tax Forms Select Year2020 Income Tax Forms2019 Income Tax Forms2018 Income Tax Forms2017 Income Tax Forms2016 Income Tax. In some estates this may require appraisals.

Local Sales and Use Tax 11172013 Title 316 Chapter 13. On February 17 2022 Legislative Bill 310 was signed into law. The Nebraska inheritance tax applies to all property including life insurance proceeds paid to the estate which passes by will or intestacy.

Her estate is worth 250000. Of the six states that currently impose inheritance taxes only two states Nebraska and Pennsylvania have chosen to tax lineal heirs children and grandchildren while the others. Title 316 Chapter 1.

Nebraska Tax Application and Return for Mechanical Amusement Device 052018 54. Patricias nephew inherits 15000. Certificate of mailing annual budget reporting forms.

NF96-236 Nebraska Inheritance and Estate Taxes. Property at the date of death. Practice worksheets to help your child to learn their basic math facts.

12 Pics about Tax Prep Worksheet 2018 Universal Network. We use cookies to improve security personalize the user experience enhance our marketing activities including cooperating with our marketing partners and for other business use. Learn more 2004 Instructions For Form.

Close relatives of the deceased person are given a 40000 exemption from the state inheritance tax. Patricias long-time friend inherits. Estate Executor Spreadsheet For Nebraska Inheritance Tax Worksheet 36.

The new law effectively reduces inheritance tax rates and increased inheritance tax exemptions for deaths. Once the amount of the. 402 475-7091 Toll Free 800 927-0117 Fax 402 475-7098.

An inheritance tax worksheet must be completed essentially an inheritance tax return and an effort made to. 36 Nebraska Inheritance Tax Worksheet - Worksheet Source 2021. Up to 25 cash back Close relatives pay 1 tax after 40000.

An inheritance tax is a state tax that you pay when you receive money or property from the estate of a deceased person. Suite 200 Lincoln NE. In other words they dont.

Unlike the federal estate tax the beneficiary.

Nebraska Inheritance Tax Worksheet 2021 Form Fill Out And Sign Printable Pdf Template Signnow

Is There An Inheritance Tax In Kansas Estate Planning Attorneys In Missouri And Kansas

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

Is There A Federal Inheritance Tax Legalzoom

Tax On Farm Estates And Inherited Gains Farmdoc Daily

Nebraska Inheritance Tax Update Cropwatch University Of Nebraska Lincoln

3 11 3 Individual Income Tax Returns Internal Revenue Service

Estate And Inheritance Taxes By State In 2021 The Motley Fool

What Is Inheritance Tax Who Pays An Inheritance Tax Estate Planning

Estate Tax Implications For Ohio Residents Ohio Estate Planning

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

How To Avoid Inheritance Tax In Ohio

Inheritance Tax Here S Who Pays And In Which States Bankrate

Nebraska Probate Form 500 Inheritance Tax Fill And Sign Printable Template Online

2021 Tax Trends Income Tax Cuts Back On The Menu

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Nebraska Estate Tax Everything You Need To Know Smartasset

Using Form 1041 For Filing Taxes For The Deceased H R Block

Nebraska Inheritance Tax Worksheet Form Fill Out Sign Online Dochub